The Honda Civic is one of the most popular cars in the United States due to its reliability, affordability, and fuel efficiency. Whether you’re a young driver, a family commuter, or an enthusiast, the Honda Civic appeals to a broad audience. However, understanding the insurance costs associated with this car is essential when calculating the total cost of ownership. Insurance rates vary widely based on factors like the driver’s age, location, and driving history, but this guide will give you a comprehensive overview of the average insurance cost for a Honda Civic in the USA.

Factors That Affect Insurance Costs for a Honda Civic

Before diving into specific numbers, it’s important to understand the factors that influence the cost of insuring a Honda Civic. These factors are similar to those that affect any car, but the Civic’s popularity and typical driver profiles also play a role.

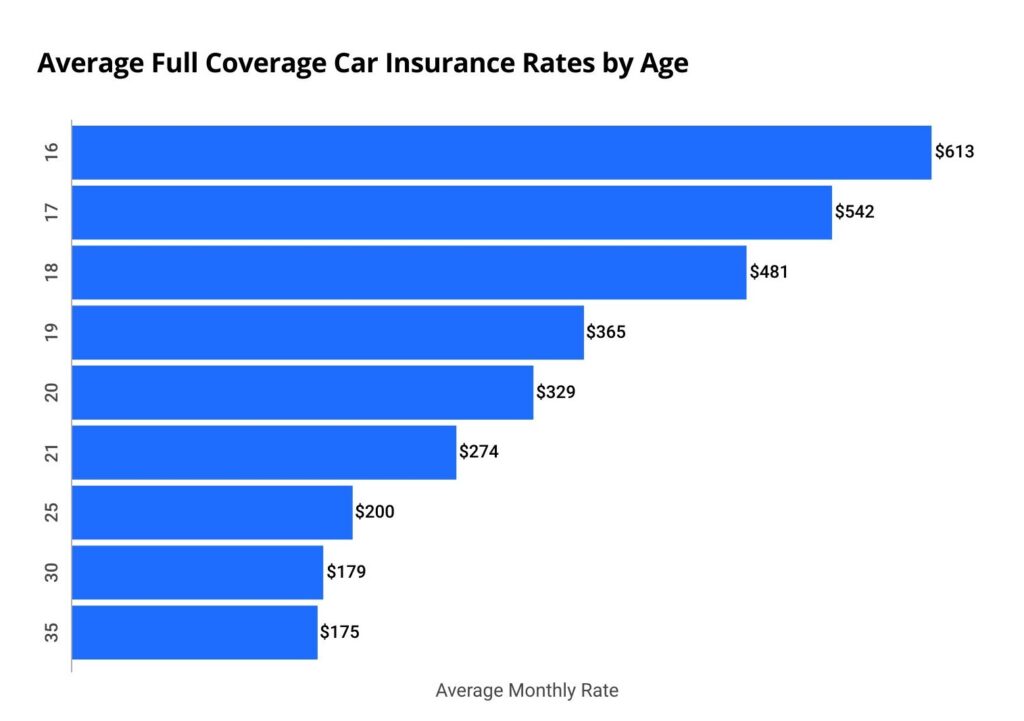

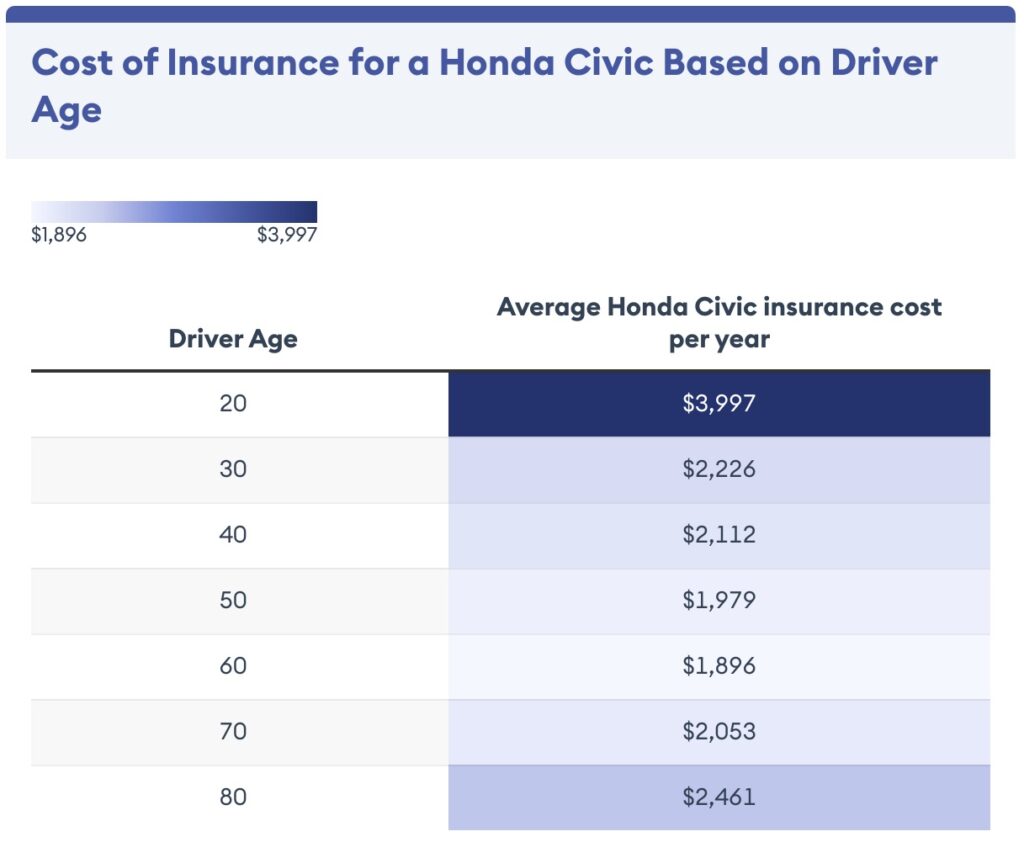

- Driver Age: Younger drivers typically pay more for insurance due to their lack of experience and higher risk of accidents. In contrast, older drivers often enjoy lower premiums if they have a clean driving record.

- Location: Where you live matters. Insurance rates tend to be higher in urban areas where there’s more traffic, higher theft rates, and a greater likelihood of accidents. In contrast, rural areas may see lower premiums.

- Driving History: A clean driving record can significantly reduce insurance costs. Accidents, traffic violations, or DUI charges will likely increase your premium.

- Coverage Type: The type of coverage you choose, whether it’s liability, collision, comprehensive, or full coverage, directly impacts the insurance cost. Full coverage is more expensive but provides greater protection, while liability coverage is cheaper but limited.

- Vehicle Model and Year: The specific model and year of your Honda Civic can also influence insurance costs. Newer models may cost more to insure due to their higher market value, while older models may be cheaper to cover. Additionally, certain models equipped with advanced safety features may qualify for discounts.

- Annual Mileage: The more you drive, the higher your insurance rate may be. Insurance companies factor in how much risk you pose based on how often you’re on the road.

- Deductible: A higher deductible generally means a lower monthly premium, while a lower deductible results in higher insurance costs.

Average Insurance Cost for a Honda Civic

The average cost of insurance for a Honda Civic in the USA can vary significantly depending on the factors mentioned above. However, for most drivers, the annual insurance premium typically ranges between $1,200 and $1,800. Here’s a closer breakdown:

- Liability Insurance: For basic liability coverage, which only covers damages you cause to others, the annual cost ranges from $600 to $900. This is the minimum coverage required in most states but doesn’t cover your own vehicle in the event of an accident.

- Full Coverage: Full coverage, which includes liability, collision, and comprehensive insurance, can cost between $1,200 and $1,800 annually. This type of insurance covers damages to your own vehicle as well as others, making it a more comprehensive but costly option.

- Young Drivers: For young drivers under 25, the cost can be significantly higher due to their higher risk profile. The average insurance premium for a young driver with full coverage can range from $2,000 to $3,000 per year.

- Older Drivers: Drivers over 40 with a clean driving record often pay less for insurance. On average, their annual cost for full coverage may be between $1,000 and $1,400.

How Does the Honda Civic Compare to Other Cars

Compared to other vehicles in its class, the Honda Civic tends to have lower insurance costs. This is due in part to its reputation for safety, reliability, and affordability in repairs. Let’s compare the Civic to a few other popular models:

- Honda Civic vs. Toyota Corolla: The insurance rates for the Honda Civic are similar to those of the Toyota Corolla. Both cars are compact sedans with excellent safety ratings, making them affordable to insure. However, in some cases, the Corolla may be slightly cheaper to insure due to its slightly lower repair costs.

- Honda Civic vs. Ford Focus: The Civic is typically cheaper to insure than the Ford Focus, especially for newer models. The Focus has a slightly higher rate of insurance claims for accidents, leading to higher premiums.

- Honda Civic vs. Volkswagen Jetta: The Jetta is often more expensive to insure than the Civic due to higher repair and maintenance costs. The Civic’s lower overall cost of ownership makes it more attractive in terms of insurance.

Ways to Lower Insurance Costs on Your Honda Civic

If you find that your insurance premiums are higher than expected, there are several strategies you can employ to lower your costs:

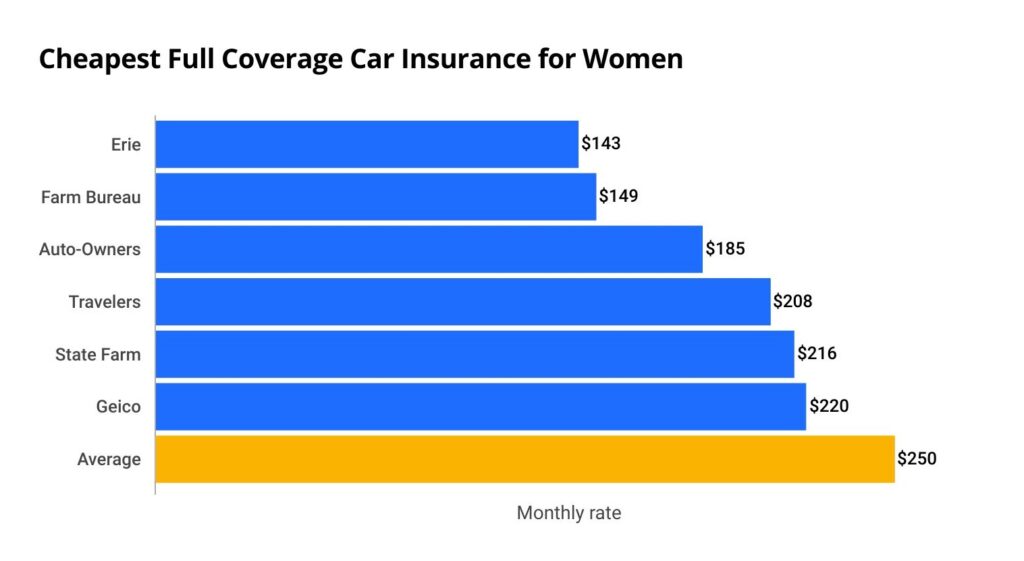

- Shop Around: Don’t settle for the first quote you receive. Compare rates from multiple insurance companies to find the best deal. Some insurers may offer better rates for certain demographics or vehicle models.

- Raise Your Deductible: Opting for a higher deductible can reduce your monthly premium. However, be sure you can afford to pay the deductible out of pocket in case of an accident.

- Bundle Policies: Many insurance companies offer discounts if you bundle your car insurance with other policies, such as home or renters insurance.

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations is one of the best ways to keep your insurance costs low. Many insurers offer safe driver discounts.

- Take Advantage of Discounts: Ask your insurance provider about available discounts. You may qualify for savings if you’re a good student, have safety features installed on your Civic, or drive fewer miles annually.

- Drive a Safer Model: Some models of the Honda Civic come with advanced safety features such as automatic emergency braking, lane departure warning, and adaptive cruise control. These features can help reduce your premium.

- Consider Usage-Based Insurance: Some companies offer usage-based insurance programs that track your driving habits via a mobile app or plug-in device. Safe drivers can earn discounts based on their driving behavior.

Conclusion

The Honda Civic is an affordable vehicle to insure for most drivers in the USA. The average insurance cost falls between $1,200 and $1,800 per year, depending on factors like the driver’s age, location, and coverage type. While young drivers and those with less driving experience may pay more, there are various strategies to lower insurance costs, such as shopping around for the best rate, maintaining a clean driving record, and taking advantage of discounts.

When choosing insurance for your Honda Civic, it’s important to consider both the cost and the coverage you need to feel adequately protected. By understanding the factors that influence your premium and exploring ways to save, you can make a more informed decision about insuring your Honda Civic.